Industrial Relations Changes for Self-Employed Tradie Businesses in Australia

What the “Employee-like” Industrial Relations Reforms Mean for Australian tradie businesses?

In Australia’s building and construction industry, what does gig work have to do with self-employed tradies, who are part of one of the second oldest professions (after escorts) in history? How does setting minimum standards for food delivery workers pose a threat to self-employed tradies?

It’s quite simple—the Australian government perceives both gig work and self-employment as “insecure employment,” aiming to clamp down on any type of work that deviates from traditional full-time employment.

Here’s an in-depth exploration of the “employee-like” industrial relations changes and their potential impact on the longstanding tradition of self-employed tradies in Australia’s building and construction industries.

Secure Tradie Jobs and the Spirit of Free Enterprise or “insecure employment.”

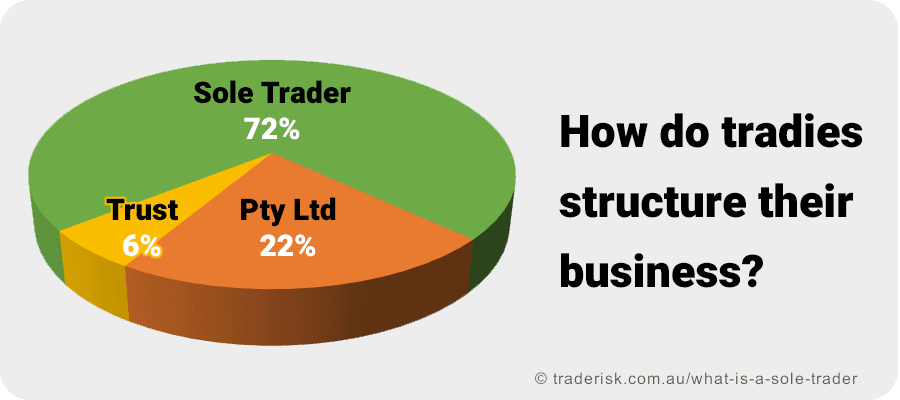

The “employee-like” policy was introduced within the broader framework of the government’s “Secure Jobs” policy initiative—aimed at enhancing “job security” by addressing “insecure employment.” However, the government has yet to precisely define “insecure employment.” Moreover, the “Secure Jobs” policies do not offer substantial benefits to workers engaged in traditional full-time jobs. Instead, these policies strive to make non-traditional work arrangements much more challenging to initiate, maintain, or utilize. This is accomplished by presenting additional obstacles, roadblocks, and bureaucratic procedures for any work that does not align with the traditional model of full-time employment. Consequently, these measures also encompass individuals working as “independent contractors,” including self-employed tradies. Notably, the building and construction industry alone boasts over 260,000 self-employed and independent tradies.

Objectives of the “Employee-like” Policy

Initially, the government positioned its “employee-like” policy as an initiative targeting “gig-workers,” “the digital economy,” and other emerging forms of work. They promoted it as a means of setting minimum standards for workers engaged through digital platforms, even coining the phrase “A Better Deal for Gig Workers.” In line with this policy, the government promised to empower the Fair Work Commission to scrutinize any work arrangement and determine whether minimum standards should be established.

The recently proposed ’employee-like’ policy encompasses a broader scope than just ‘gig-work’ or ‘new and emerging forms of work.’ It encompasses any non-traditional, full-time employment, potentially resulting in a complete overhaul.

This could have significant ramifications for self-employed tradies in the building and construction industry who have relied on independent contracting arrangements for over a century. They may be compelled to transition into traditional employee roles, with the possibility of losing their businesses altogether.

How does the employee-like policy work?

In essence, individuals engaged in work arrangements must now seek approval from the Fair Work Commission to exempt their arrangements from being treated as traditional, full-time employment.

This obligation extends to independent contractors and self-employed tradies, who must fulfill a series of criteria to establish themselves as ‘genuine’ independent tradies and justify exemption from employee classification.

While these criteria would typically be straightforward, the Government’s ’employee-like’ policy intends to introduce a more intricate and rigorous assessment process.

This means the criteria will be intricate and encompass complex legal considerations, resembling a legal court scenario.

Substantiating independence would entail providing numerous documents and information. Unfortunately, the test will disregard the parties’ intentions, desires, or written agreements.

In essence, self-employed tradies’ desires, intentions, and freely negotiated agreements will hold no weight in determining their employment status.

Instead, the test will emphasize other factors, adjudicated by a tribunal specializing in employment matters rather than independent contractor issues.

It is crucial to note that compliance with the test will not be a one-time affair and may require repeated assessments. Tradies might have to go through assessments again and again and again.

What happens when tradies fail assessment?

If the test requirements are not met, any work arrangement will not be considered genuine. As a result, the involved parties may be compelled to establish a traditional employer-employee relationship. This implies that even if both parties prefer an independent contractor arrangement, they could be compelled to adopt conventional employment practices. It is important to note that the desires and statements of the involved parties may not have the final say, as someone with limited knowledge of the construction industry in Australia could ultimately make the decision.

Will the test mean being exposed to union control?

The tests for maintaining individual control over employment status present various considerations and potential challenges for self-employed tradies and independent contractors.

One significant factor to consider is the cost involved in satisfying the tests to establish genuine independent tradie status and prevent becoming an employee. This process may necessitate legal assistance, which can add to the financial burden.

Additionally, the time invested in preparing for and undergoing the test process is an opportunity cost for self-employed tradies, as it takes away from their potential work hours.

Another concern relates to unions and their increased rights to intervene in the test process under the “employee-like” policy. This provision aligns with the broader entitlements granted to unions in other Fair Work processes. Consequently, unions may exert greater influence over the rights and arrangements of self-employed tradies, potentially affecting aspects such as hours and pay.

It is important to note that the preferences and desires of the affected parties may not hold sway in this context, as unions’ involvement is likely to be substantial. The union’s push for a standardized approach may implicate both the retention of rights for self-employed tradies and the establishment of minimum standards for specific arrangements.

In the building and construction industry, this situation is known to generate pressure on individuals to comply with union directives, adopt a one-size-fits-all approach, and conform to union demands regarding aspects of their business operations.

These pressures are heightened by the parallel efforts to encourage self-employed tradies to join the union, a move that can have financial implications, particularly for small business owners.

Will meeting the test guarantee preservation of tradie rights?

Even if the complex tests are met and individuals can prove the authenticity of their arrangement, it does not automatically allow them to retain all self-employment rights as independent contractors.

The Fair Work Commission must also assess the possibility of establishing “minimum standards” for such arrangements, even if they are proven to be genuine independent contractor situations.

These “minimum standards” are expected to encompass the following areas:

- Permissible and prohibited working hours

- Methods of seeking, offering, and accepting work

- Minimum requirements for insurance coverage and expenses

- Appropriate payment rates and terms

- Working hour restrictions

- Decision-making authority regarding job selection and client assignment

- Protocols for future arrangement discussions and operations

Implementing these standards would significantly constrain the rights of self-employed independent tradies in the building and construction industry, potentially limiting their ability to choose clients, accept projects, and set their own rates.

What is Master Builders’ Association of Western Australia’s stance on the ’employee-like’ policy?

Master Builders is expressing the concerns shared by many regarding the potential impact of this policy on self-employed, independent building and construction tradespeople. It is important to revisit the government’s initial statement, which indicated that the ’employee-like’ policy would primarily address ‘new and emerging’ forms of work, such as gig-workers operating outside existing regulations.

The policy should not encompass the over 260,000 independent contractors and self-employed tradespeople in building and construction, who have historically worked in this manner for more than a century. These individuals have consciously chosen to establish their own small businesses, work independently, and retain control over their work, schedule, and rates.

Tradespeople do not require third-party intervention to dictate their decisions, impose work conditions, or undermine their existing rights as self-employed individuals. It is crucial to note that the government never explicitly stated that the ’employee-like’ policy would be relevant to tradespeople. This policy is not related to gig-workers or the digital economy, but should solely align with the government’s original intentions.

To ensure this outcome, we seek your support by joining the campaign. You can write to your local MP, sign our petition, and share your thoughts on www.defendyourrights.com.au. Together, we can safeguard the rights of self-employed, independent building and construction tradies.